Earlier this month another story of a million dollar HDB flat hit the news headlines: a 40-year-old executive maisonette in Potong Pasir sold for S$1.24 million.

The 1,733 sqft unit has barely 59 years on its lease left.

This followed similar transactions of S$1.25 million, for an apartment on a higher floor nearby, conducted in the same month, or S$1.16 million recorded in February.

It isn't anything new, of course, as the number of such sales has shot up in the past 4 years, with one of the most glaring examples being a S$1.1 million 4-room in Tiong Bahru, which had just 51 years left on its lease when it sold in 2020.

Following 470 transactions in 2023, 2024 is shaping up to be another record year, as the number of million-dollar sales has already reached 419 – in the first six months alone.

After spending many months under lockdowns Singaporeans rushed to buy apartments – usually larger ones – driven by the experience of working from home, which has now become a standard for many companies (at least part time), even as pandemic ended.

As numbers of sales started climbing it's quite likely that more buyers joined the frenzy, anticipating further inflation of housing prices – particularly of the most spacious units, whose supply is the most limited.

Of course, those million-dollar-plus properties still only account for around 2% of all sales, but the trend remains strong and rising prices are pulling the rest of the market higher as well.

But why are people willing to pay so much, really? And even if their leases are relatively short?

Because they really are a bargain.

Housing as a service

For decades properties have been considered a safe asset, something you want to have in your portfolio or even invest in for profit.

However, the world is changing and a growing number of people choose to live more convenient lives, instead of hoarding wealth for future generations. It is perhaps in part due to the fact that Singapore is already very wealthy, offering even the young very good perspectives for the future. That said, this evolution of habits is observable around the world.

Owning things isn't as big of a social status symbol as it once was. Experiences and convenience you can allow yourself are.

In Singapore's HDB system home ownership is inherently transient anyway, limited by the 99-year leasehold, upon expiry of which the buildings and land are returned to the state.

In the early days, given the lease extending far beyond the lives of first buyers, it was an investment too – and a very profitable one.

However, as some of the older blocks are reaching the midway point, apartments they house are treated more like a flexible rental, which you pay for in advance, than an asset you invest in.

It becomes a service, with the added benefit of ownership which allows you to remodel your new home as you see fit.

Anybody coming from a traditional perspective would decry spending over a million dollars on a flat expiring in little over 50 years, as a money pit.

But when you consider its value from the perspective of buying yourself a permit to live in a massive apartment, it becomes clear it's a steal.

Let's circle back to that Potong Pasir maisonette. It had 703 months of lease left on the date of the purchase. At a sale price of S$1.24 million + around $35,000 in buyer's stamp duty, it translates to around S$1,800 per month.

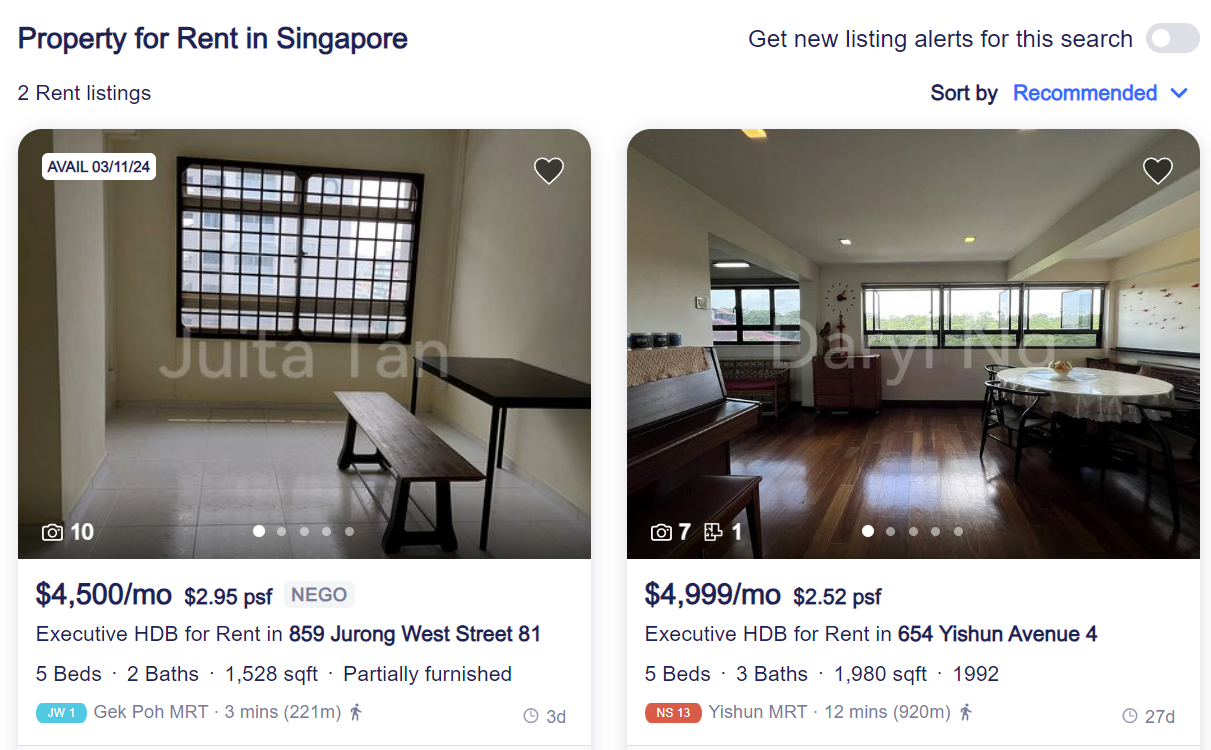

Renting a comparably sized HDB property would cost you at least 3 times as much, even in an inferior location, and you would forever be at the mercy of the owner.

Mind you, that doesn't even factor in future inflation, which makes the purchase relatively cheaper with time.

Buyers of these apartments are paying for comfort and convenience, and are not concerned about the decline in value over the long term. They're living here and now, not in the future.

And here and now allows them to enjoy remarkably spacious living in one of the most densely populated cities in the world, at a monthly price lower than a studio rental. What's not to like?

Add another two, three hundred thousand for modernisation, and you've just bought yourself a near-condo living standards in an excellent location, that you may enjoy until your death (since I don't think 20-year-olds are buying these anyway).

At the same time, however, they will be able to sell their homes (if need be) for the residual rental value of the remaining period of the lease.

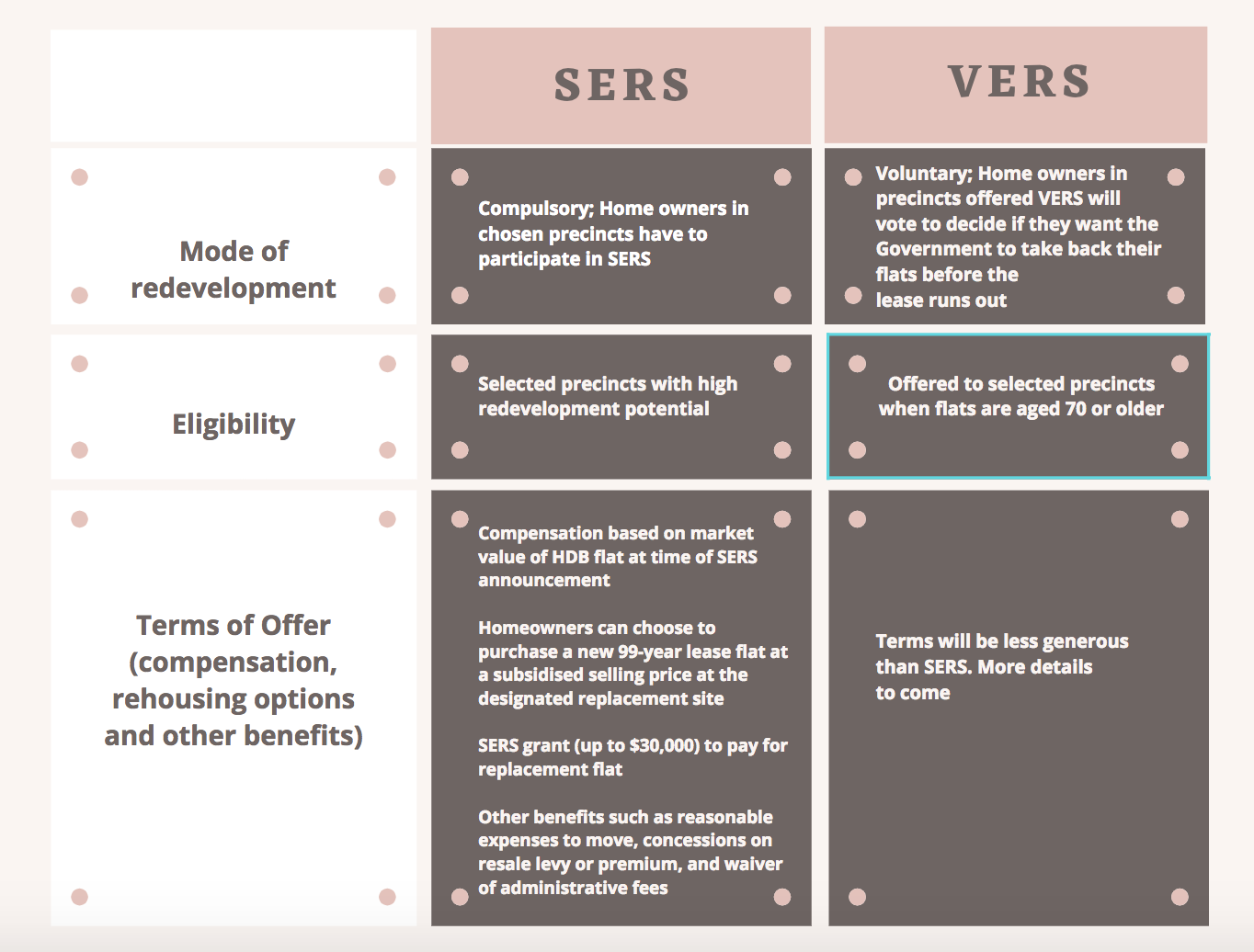

And if they're exceptionally lucky, they may even qualify for a SERS or VERS scheme at some point down the road.

There are hardly any downsides – unless you treat your HDB as an asset, an inheritance left to your offspring, rather than a service provided for your comfort during the remainder of your life.

The pandemic has only accelerated a trend which has already been in motion, as many people experienced first hand how limiting a small apartment is – and how valuable being able to live in comfort, while periodically working from home, is in comparison.