Some people - including a follower of mine here - disagreed with my assessment outlined in the Vulcan Post article from a week ago that Singapore has gotten richer by over S$200 billion during the pandemic.

We actually had a productive exchange in the comments under one of the posts on my Facebook with the author of the blog entry mentioned by TOC. Of course, these "journalists" simply keep an eye out for any bit of commentary that is specifically negative about Singapore - anything that could convince Singaporeans that their country is nowhere near as good as it actually is.

And they do it so senselessly and incompetently that they are eager to give publicity to opinions that are mutually incompatible - as long as they can put Singapore in a bad light (small wonder, perhaps, as most of them are actually Malaysians).

We'll get to my post in a second, but for the moment, please take note of the fact that in their recent article, they are claiming - on the basis of the opinion of the blogger - that Official Foreign Reserves held by MAS are not really a part of Singapore's reserves.

Meanwhile, in April, they made an opposite claim, presented by Leong Sze Hian - the other "blogger", who is really Lim Tean's buddy from People's Voice (Lim Tean is also a lawyer representing both LSZ and Terry Xu in their court cases in SG - happy three friends).

Leong Sze Hian - a financial professional no less (though I can't fathom how) - claimed that Singapore actually has reserves of S$1.48 trillion, and the government doesn't want to reveal it as not to appear "stingy"

Turns out that in the TOC world, Temasek is not doing well enough, the country is not getting richer, but it also has gigantic reserves that the government is afraid to reveal because they're so big.

How are these views compatible?

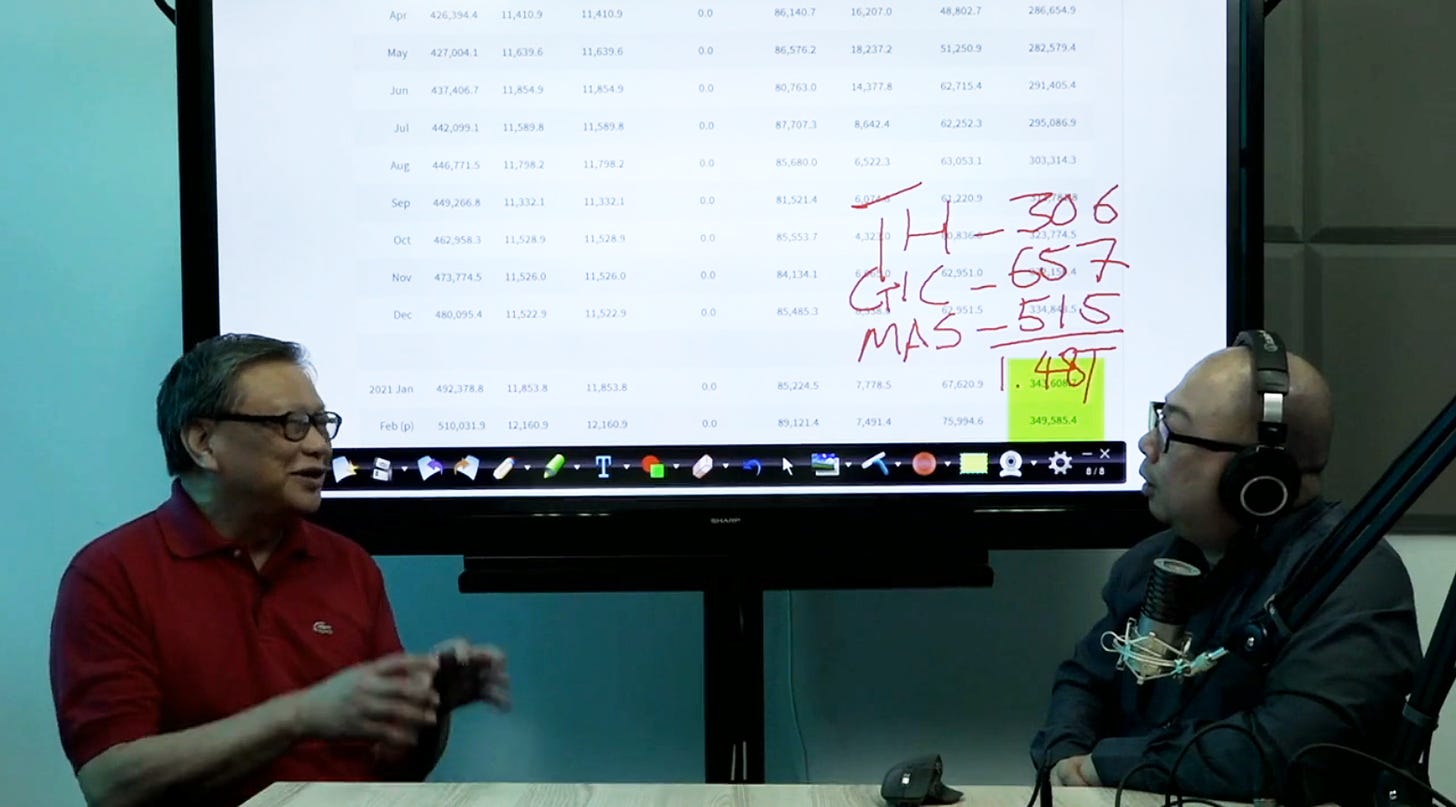

Secondly, LSZ arrived at the figure of S$1.48, adding all the funds in GIC (estimated), Temasek and... Official Foreign Reserves.

So, are OFR a part of the reserves or not? It would be good if TOC decided what's what.

And if they are, Is the figure of S$1.48 trillion correct? (actually, no).

He made a mistake opposite to the one my recent critics have. LSZ used the total figure of estimated assets under management of GIC (published by Global SWF), which was US$488 billion at the time.

However, the bulk of the funds that GIC manages come from the sale of special bonds for which the CPF is exchanging its money. I.e. GIC is actually managing ca. S$474 (US$347) billion in CPF funds that are not a part of the reserves. Only the remaining money can be classified as such.

So, how much is there in the end? About S$1.1 trillion - HOWEVER, this isn't so simple (I am going to explain it in another article in the Vulcan Post shortly).

Anyway, let's get back to the current accusations - has Singapore really gotten richer by over S$200 billion during the pandemic?

Yes.

In fact, the entire country (private and public sectors combined) has gotten wealthier by around S$350 billion.

How? Why?

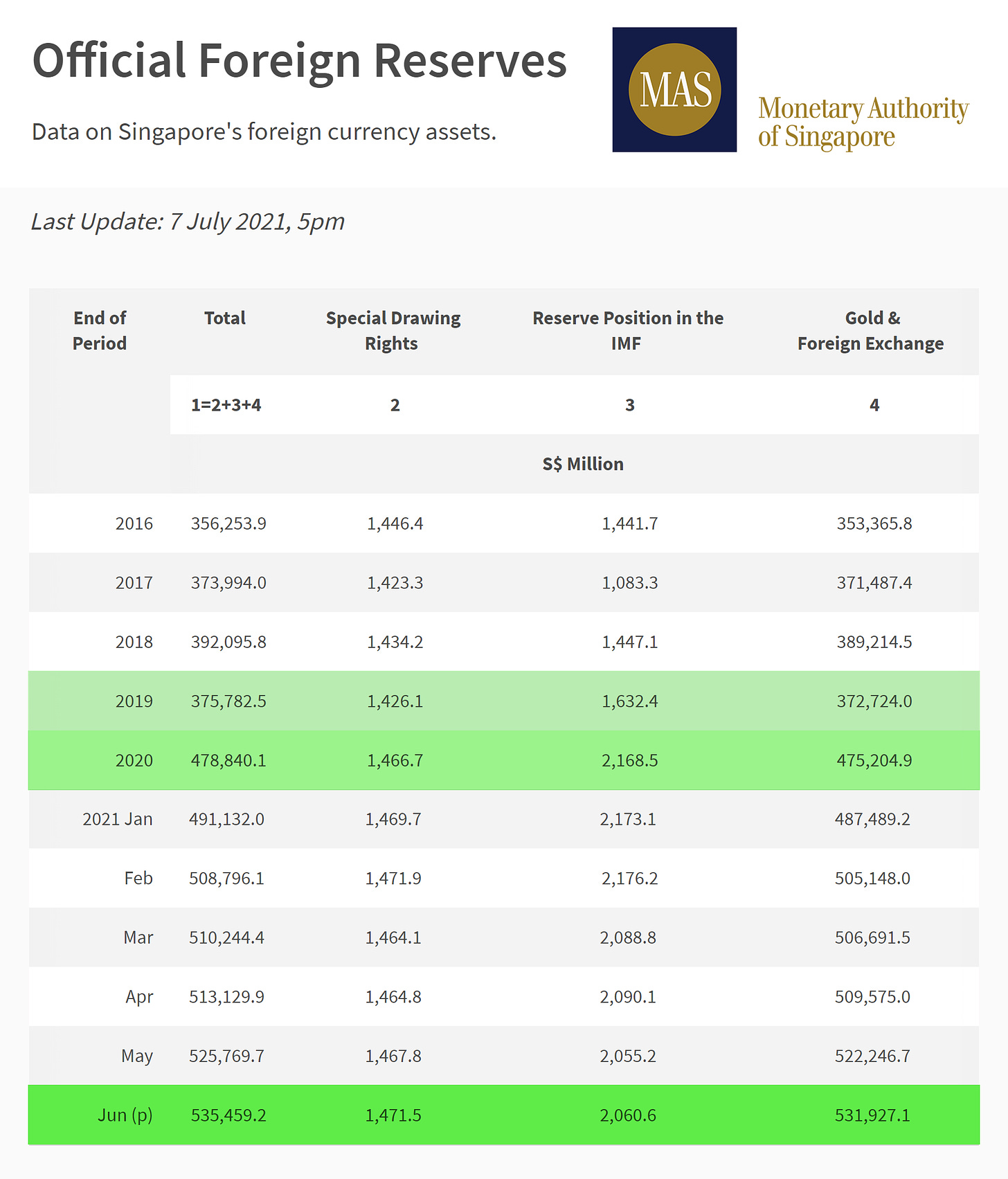

As I explained in the article (again, you can read it here), the portfolio managed by Temasek increased in value by S$75 billion, GIC is sure to put in very good figures too AND the Official Foreign Reserves have grown by S$160 billion.

That's why, even if we subtract the S$54 billion in supportive measures helping the economy survive the pandemic, Singapore is easily over S$200 billion better off than before (S$75 billion in Temasek, S$160 billion in OFR and easily tens of billions in GIC).

Now, some people have questioned the inclusion of OFR figures in this assessment. They say this increase results from MAS activity and is matched by a similar rise in liabilities on its balance sheet.

And yes, this is true because that's how a central bank works.

Let me explain what happened (newbies may feel a bit overwhelmed now, I apologize).

Money tends to flow to countries that are more trustworthy, safer, and have a lot of value to offer. This phenomenon is typically amplified by economic crises, when funds actually leave weaker economies and move to safe havens like Switzerland or... Singapore.

With an influx of foreign money, there's a growing demand for local currency - here, the Singapore Dollar. Now, if the central bank (MAS) didn't intervene, SGD exchange rates would grow too high and domestic exports would suffer, becoming less competitive.

Every central bank in the world has its own policy targets - MAS is targeting exchange rates to maintain a predictable, stable environment for international trade.

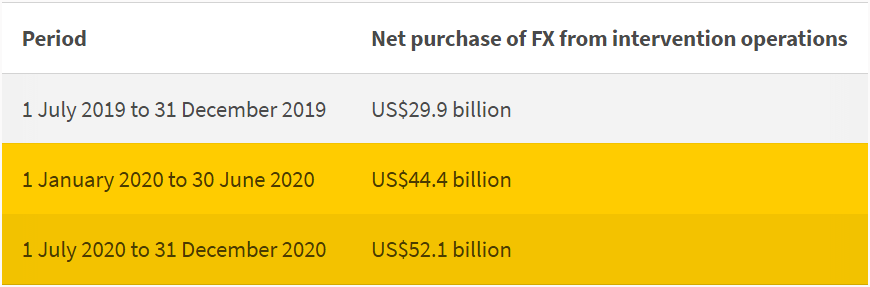

With lots of money coming in, MAS intervened last year, accumulating foreign currencies to the tune of US$100 billion.

The unfortunate side effect to that is that there's a lot more SGD in the market (MAS buys USD et al with SGD) - and that would affect the liquidity of the domestic banking system. Ca. $160 billion SGD sloshing around is not something MAS wants either.

So, what it does (like all central banks) is issue its own bills that local banks invest in, absorbing the excess currency from the market, taking it on as a liability onto its own balance sheet.

This is called "sterilisation" - which is basically a policy of counteracting unwanted side effects of other decisions.

Ultimately, then, MAS has acquired S$160 billion worth of foreign assets, while absorbing excess Singapore Dollars through the issuance of its domestic bills.

The net impact to its balance sheet is, predictably, negligible - more assets + more liabilities, the balance is about the same (as it has to be).

But the impact on the entire country is not.

You see, foreign reserves are really just accumulated excess demand for domestic currency. MAS didn't *have to* intervene if it didn't want to - it could just let the market set however high of an exchange rate it wanted. But due to economic policy goals (i.e. protecting exporters from these huge swings), central banks typically balance out this excess demand and take the surplus foreign currencies under their control.

These funds allow them not only to defend the currency against outflows of capital (which could crash the exchange rates in the opposite direction) but are also a pool of money that can be invested abroad.

This is how GIC was born, actually. Back in the 1970s, when Singapore was booming, it acquired significant currency reserves (foreign companies investing in SG, bringing their currencies, exchanging them for SGD), which exceeded the monetary policy goals. So, a decision was made to simply create a corporation that would manage some of these funds for higher profit, earning the country more money in the process.

It is still happening to this day, as MAS occasionally transfers large sums of money to GIC for management (like it did in 2019 when it moved S$45 billion there).

Because OFR are held in highly liquid assets (to respond to major needs quickly), they typically do not yield high returns. But if there's too much money that would typically be needed to manage the currency exchange rates, some of it can be invested in something more profitable (via GIC).

So, does the accumulation of foreign currency reserves make the country richer? Yes, but not in the way you might think.

Since the money cannot be spent - because it's there to protect the currency - you just can't use it how you please. That said, a lot of it can still be profitably invested, on par with all other reserves at the government's disposal.

Secondly, OFR are reflected in the country's International Investment Position.

IIP is a measure of all of the nation's foreign assets (for both public and private sector - individuals, companies, and government).

This figure has grown for Singapore during the last year by a whopping S$350 billion, to very nearly S$1.4 trillion

What does it mean?

- That Singapore is a net creditor nation to the rest of the world - it invested more abroad than the world invested in Singapore.

- If, hypothetically, the country wanted to pay off all of its liabilities and sell all of its assets, the figure it would net is S$1.4 trillion - S$350 billion more than before the pandemic. (OFR are a part of this figure, as they are foreign assets owned by MAS.)

(Why aren't domestic liabilities counted in this? Because for this metric, the country is treated as a whole vs. the world. Think of it as borrowing money from your mum. She holds an asset - a loan she gave you - and you have a liability to repay her. But *as a family* nothing has changed.)

So, yes, as you can see, Singapore has, indeed, grown richer in the past 18 months - and in line with the figures I reported.

BUT, it should not - again - mean that this money can be spent or that the funds held by MAS are no different than the money managed by Temasek or GIC. No, they serve different purposes and cannot be used in the same way (this is why there are three different entities managing them, not one).

This complexity has to be recognized. Just because the country owns more doesn't mean it can spend more immediately - although it can make more money on the basis of its increased wealth.

These are not simple, black-and-white matters.

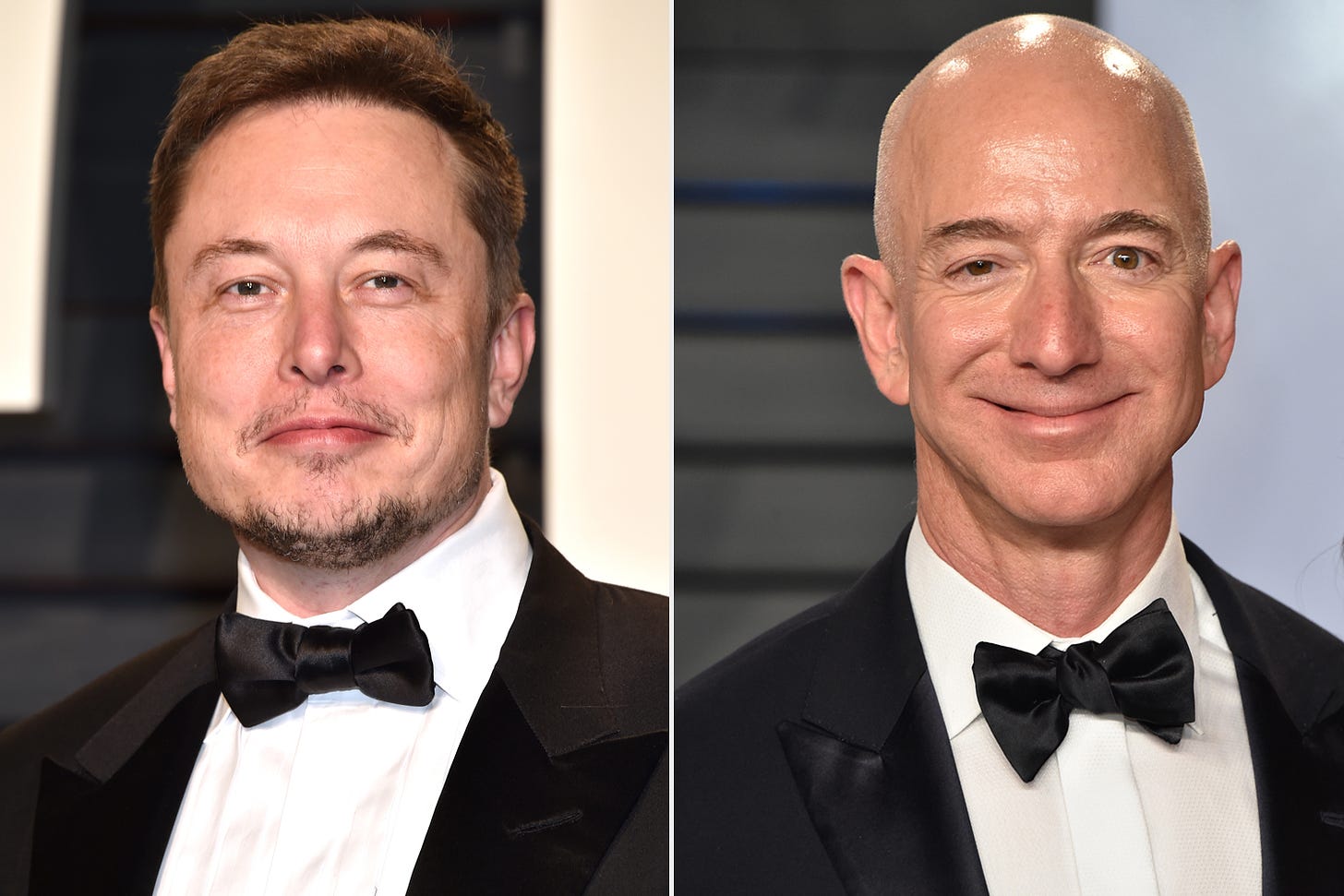

Singapore is, essentially, just like Jeff Bezos or Elon Musk of nations. During the pandemic, billions of dollars flowed to the world's most promising, biggest, most successful companies - elevating their market capitalizations and the wealth of their founders.

On a national level, they have flowed to the best performing, most trustworthy countries - like Singapore - generating higher demand for their currencies and inevitably pumping up their foreign reserves - and national net worth.

PS. Everybody is free to come here - to my website or Facebook page - and counter my arguments. If you think I have erred in something - please point it out. I may or may not disagree with you, but I won't necessarily hold a grudge because of that as long as it's done in good faith.

I certainly cannot say that of TOC and their way of framing everything as an accusation against Singapore, though.