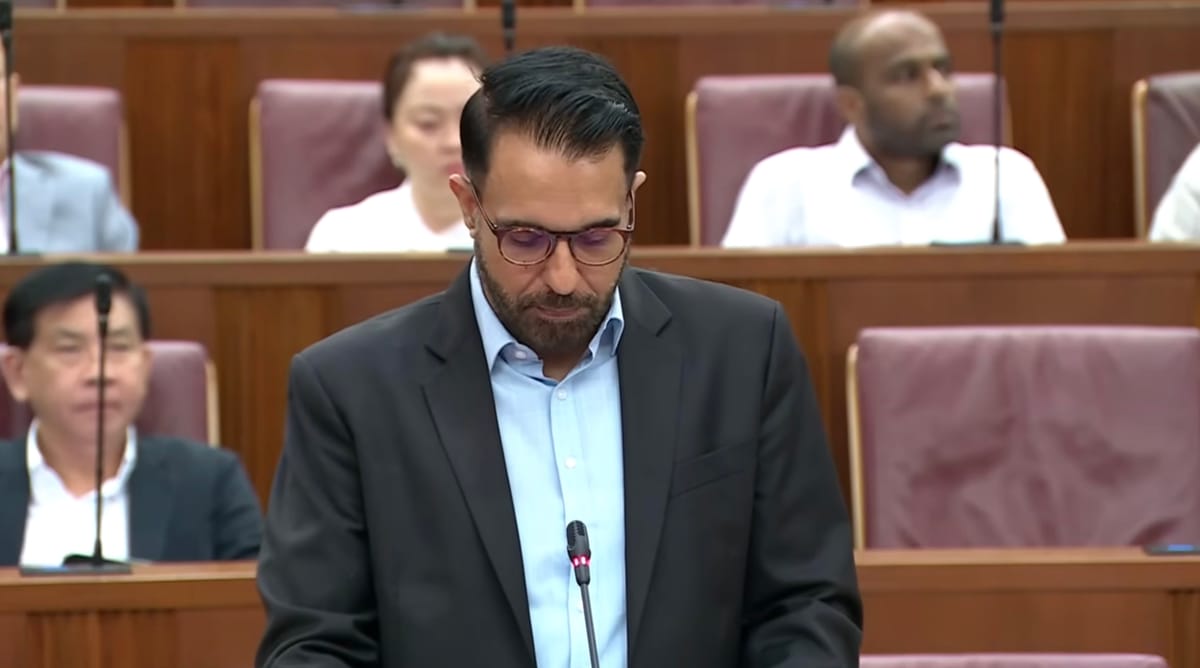

Two years have now passed since Jamus Lim suggested borrowing money to fund additional spending by the government during a parliamentary debate on i.a. minimum wage in September of 2020.

Subsequent events of these two years show us who was right on policy - and the differences between economic theory and harsh realities of running a country.

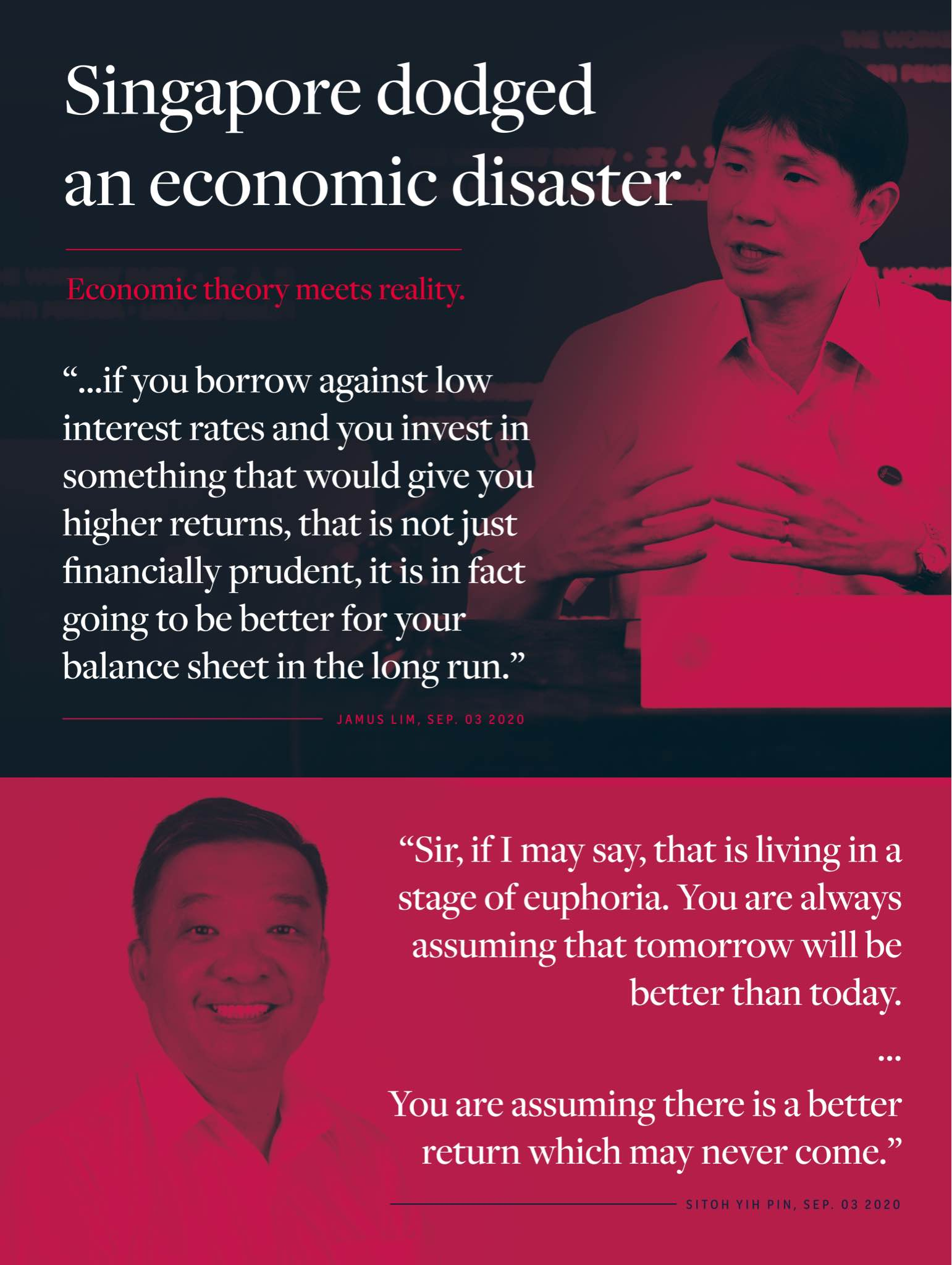

Back in 2020 Jamus Lim was arguing that the government was "over-saving" and that it should use beneficial economic conditions of very low interest rates to borrow more money and spend it domestically, to somehow help Singaporeans (hard to say what the "investment" Jamus had in mind really meant).

Singapore is, indeed, run so well that its borrowing costs have for many years now been below its investment returns from the reserves.

So, a case could be made for issuing more debt and, even if not throwing the money into the crowds, then at least placing it in the safe hands of GIC or Temasek to collect the premium.

The problem with that, however, is that you never know how long the good times will last. And when they end, you're hit with a double whammy, seeing your investments suddenly drop in value while your borrowings become a lot more expensive to service.

During the very same debate (you can find the full transcript on the website of the parliament) Jamus called himself "much more of an ideas person" - and you can see why.

It's easy to think about policy and come up with ideas you bear no responsibility for. It's not your money at stake, after all.

You can gamble with public funds and then shrug when the unexpected happens, saying that nobody really predicted it - just like it was with the surge in inflation and, subsequently, interest rates around the world from 2021 onward.

Major companies have tumbled by 20-40-60 even 80% from their stock market highs of 2021. Meanwhile, borrowing costs have gone nothing but up.

The good times ended not even a year after Jamus made his comments, highlighting just how tumultuous and unpredictable the global situation may be.

This is the reality of policymaking. You can't assume the future will be rosy - you have to be prepared for the worst, including a scenario of having it hit you unpredictably just a few months down the road.

Before making any policy recommendations it would be advisable for Jamus Lim to have thought about an alternative scenario. What if interest rates suddenly spike? What if the world is shaken by record inflation? What if a nutcase in the Kremlin starts a war?

Does it, then, make sense to get into debt that the country itself doesn't absolutely need, just to embark on a string of populist policies, which may end up costing a few times more than anticipated?

Sitoh Yin Pin, PAP MP, made a cautionary remark to Jamus at the time. Unlike the university tutor, he's a professional accountant with 30+ years experience - here's his full comment, before the follow up reply I cited in the image:

"As an accountant, I am rather perturbed by something Assoc Prof Jamus Lim said just now. If I heard you correctly, you said that given low interest rate, it is now time to re-mortgage your properties.

As an accountant with over three decades of experience, I can tell you that is how people start getting into trouble. I hope you are not teaching that in your classes.

But to my knowledge, Singapore is one of the very few countries in the world, maybe the only one that has not got to borrow in such pandemic times.

Having a balance sheet is good, having savings is not a sin, having savings like the way we have it, is very good. So, may you clarify on what you have just said? I hope I heard you wrongly."

Sadly, he didn't but fortunately, it's not Jamus Lim who makes these decisions.