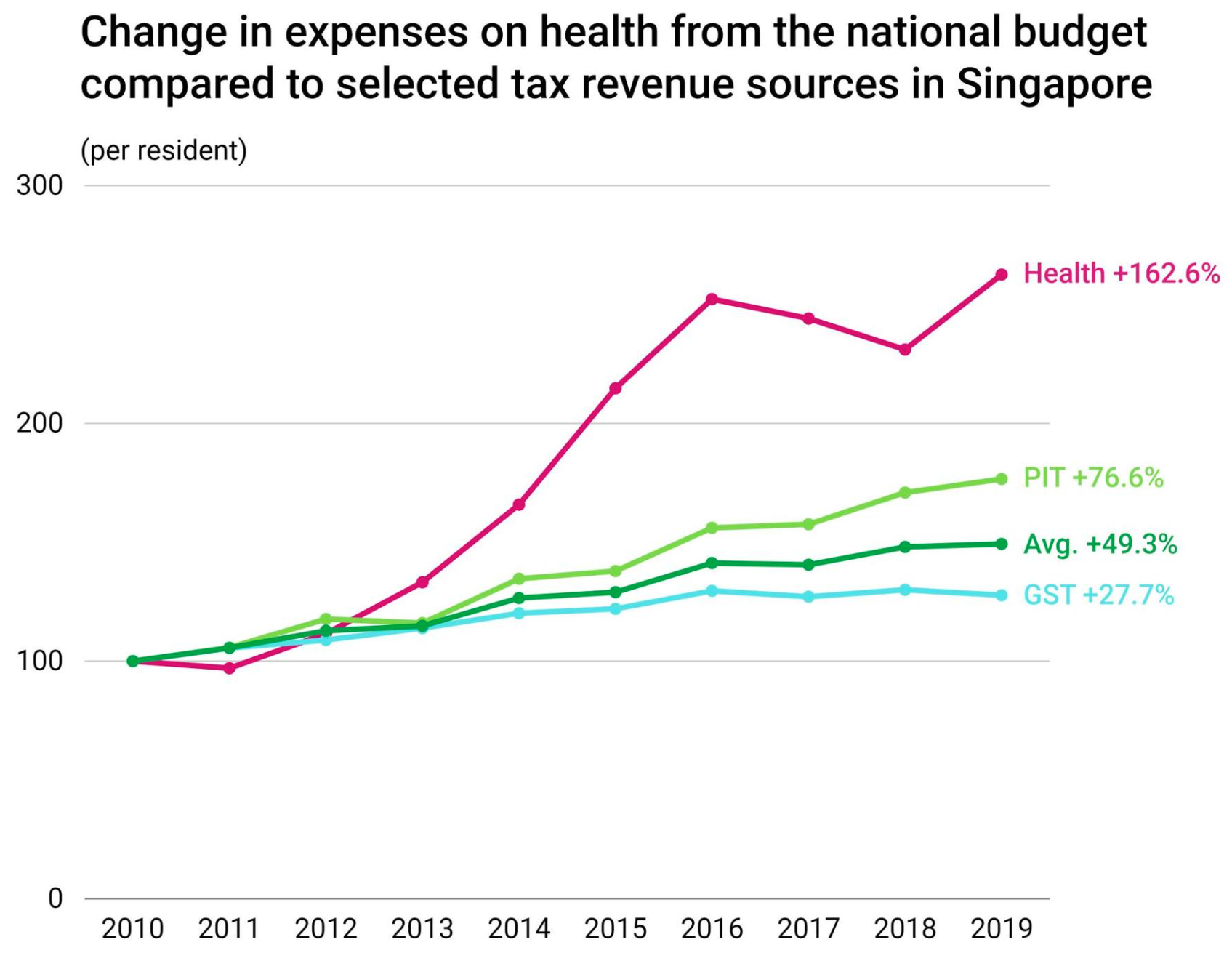

Nine percent GST rate is upon all Singaporeans, starting January 1st of 2024. Here's, one final time, one chart and two reasons which explain why the tax is going up.

Reason no. 1: the society is getting older, requiring higher expenses i.a. on healthcare from the national budget.

As you can see, the rise in healthcare spending has already greatly outpaced the rise in revenue from different tax categories and this trend is only bound to get worse with time.

Reason no. 2: there's no other source of revenue which can be increased.

Personal taxes can only be nudged up a little - and they are going up to 24% for the highest earners in 2024 too. But those wealthiest residents won't stay in Singapore for long if it wants to squeeze them even more.

They also already pay obscene amounts of money for housing and cars, so it would not be very prudent to drive them away by being too greedy, because then they will pay zero.

Let me remind you that the Top 10% of the wealthiest taxpayers already contribute 80% of all of the personal income tax revenues. Enough.

NIRC, similarly, cannot be raised beyond what is already drawn from the reserves, since they have to grow at least as quickly as the GDP (preferably more), so that the proportion of NIRC can remain the same or grow in relation to budgetary expenses.

That's why every proposal to draw more money is irresponsible and, in truth, very dangerous.

The only thing that can go up, as it remains relatively low compared to most other developed countries, is GST.

At 7% it was one of the lowest rates in the world and will remain so at 9%, while boosting revenue by a few billion dollars per year.

And most of it will still be paid by the wealthiest residents and passing foreigners.

All of that for the purpose of guaranteeing current and future benefits for all Singaporeans.