Yesterday I ran into this opinion piece published in the Straits Times:

I'm not sure what I'm more appalled by - the proposal or the fact that it was written by a lecturer at LKY SPP and a PhD candidate from the school.

In another episode of "why non-STEM academics are useless", we have a proposal for a wealth tax or even inheritance taxes in Singapore.

Now, if this were written by some snotty-faced left-wing blogger, I wouldn't really pay much attention to it - but this comes from people who represent the School of Public Policy named after Lee Kuan Yew himself.

While I do not know what is being taught in the school, I am deeply alarmed that, after half a century of world-class and, in many ways, pioneering fiscal policy, which has created a one-of-a-kind system which relies for a large part on returns generated from investments, someone would seriously suggest another tax - particularly one that is unfairly targeting the wealthy - as an element in increasing budgetary revenues.

If it seriously comes from any person from a school that's supposed to set standards for public policy, then I'm sorry to say, but the lessons of that half a century have gone down the toilet.

If the best that SPP’s academics can recommend is going back to taxing the rich, then what is the school for altogether? We’ve heard this for a hundred years - do we seriously need new generations of talking heads regurgitating the same old slogans of taking from those who seemingly have more than others?

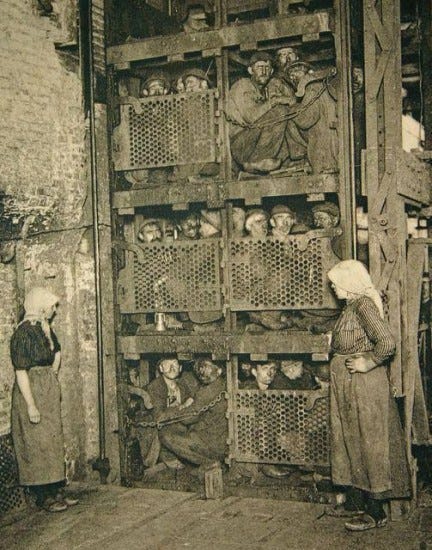

These ideas are as old as the legend of Robin Hood.

Turns out that practical, measurable examples of governance, which have produced globally unique fiscal results simply cannot penetrate an academic mind infected with the drivel of the likes of Thomas Piketty.

Let's get the dumbest element of the whole debate out of the way, as it is unfortunately seeping through from the demented West into Singapore, along with other hare-brained ideas - INEQUALITY DOES NOT MAKE YOU WORSE OFF.

Why should it matter if someone at the top is worth billions of dollars due to the appreciation of shares he owns in a company he founded or runs if your living standards keep going up? His wealth and your income are completely disconnected.

The topic of "inequality" has only garnered traction because of the Marxist narrative that - yet again - tries to pit people against each other by falsely dividing them into social classes that are defined as mortal enemies.

I really can't believe that after 150 years and millions dead to the lunacy of Marxism, we are still allowing its tenets to shape public discourse, despite the catastrophic toll they have had on humanity.

The undertone of these discussions is very clear - the rich are too rich (and unfairly so) and we have to rob them of something they have to give it away to someone else for nothing. It's a thinly veiled vilification of people on the basis of their economic success. Politics of envy.

"You make profit a dirty word and Singapore dies", Lee Kuan Yew said in 1980, and now people representing the school bearing his name are actually saying - "profits are bad, wealth is bad, we have to tax those who make too much".

Do you know what happens next? Singapore dies.

What a marvellous idea to chase away the wealthiest domestic taxpayers and investors by imposing an additional tax on assets that may not even be monetary and whose valuation is entirely arbitrary.

Soon enough, they recalculate their expenses and pack their bags to go somewhere else or optimize their holdings to avoid paying most of the taxes altogether.

Contrary to popular belief, Singapore is not really a tax haven. Local taxes are low - but they are low primarily for regular taxpayers. Median income earner in Singapore pays 3-4% in income tax - close to nothing.

Meanwhile, the top bracket of 22% is not so negligible, particularly if you pay most of it on your total income of millions of dollars. 17% corporation tax isn't low by global standards either, and you can find countries (even in the EU) that offer much lower rates than SG does.

This comes on top of high living costs for the wealthy. Let's bust another myth while we're at it - in reality, Singapore is a cheap country for the poor but an expensive one for the rich.

With subsidized housing, healthcare, education, cheap public transit, very cheap and abundant food, low taxes and ample social welfare, you don't really need much to get by in SG on a low income.

But being rich in SG comes at an entirely different price tag. You no longer live in cut-price HDB but pay multimillion-dollar prices for private housing. A car costs you 3-4-5 times as much as it does anywhere else in the developed world. Taxes and other fees on a single premium vehicle can run up to several hundred thousand dollars. And if you happen to own a few (as many rich like to), your bill is in the millions - something you wouldn't have to pay in Europe or America.

Slapping a wealth tax - even if small - on top of it all could be the final straw for many people - and I've already heard complaints about the top income brackets before.

Instead of allowing their wealth to be taxed, they will end up paying 0% on it, as well as 0% in income taxes, 0% in GST and won't spend a dollar on any services, shopping, dining or housing, as they simply sod off somewhere else.

And then a miracle would happen! With the rich gone, inequality would quickly drop, as they would stop skewing the statistics, and academics would quickly celebrate this great success in achieving a more "inclusive" society! (whatever that means...)

But would the country - and everybody in it - be better off?

No.