Just when you think things can't possibly get any worse, folks from PSP outdo themselves again.

The set of proposals for HDB they announced yesterday is so absurd and destructive that I don't know where to start debunking them. I could write several pieces dissecting their every element but I'll stick to two posts to highlight the two key takeaways:

1️⃣ Contrary to what PSP claims, their "cheap housing" ideas would end up costing Singapore billions of dollars each year - even by their own figures.

2️⃣ In reality it would be much worse, because what they proposed would completely destroy the housing market and most of the value in it.

In this post I'll focus on no. 1.

It's funny to see how Mr Leong Mun Wai was forced to take a step back from his proposals of not charging people the cost of land their apartments are built on :) His current proposal calls for doing it only when they want to sell their apartment.

In other words, when buying a BTO flat from the government you would only pay for construction costs but when you want to sell, the current cost of land would be deducted from the final price.

This way, PSP claims that:

1. Housing could cost less than half of current prices (they gave an example of a flat in Tengah which costs $350,000 which would be reduced to just $140,000 under their proposal).

2. Existing homes would not lose their value, because land costs would still have to be paid when the apartment ends up in the resale market.

3. Reserves would still receive money from land sales, when people sell their apartments.

Ultimately, LMW said that "Affordable Homes Scheme will not have a major impact on the nation’s fiscal position and reserve accumulation."

Well, let's check this, hm?

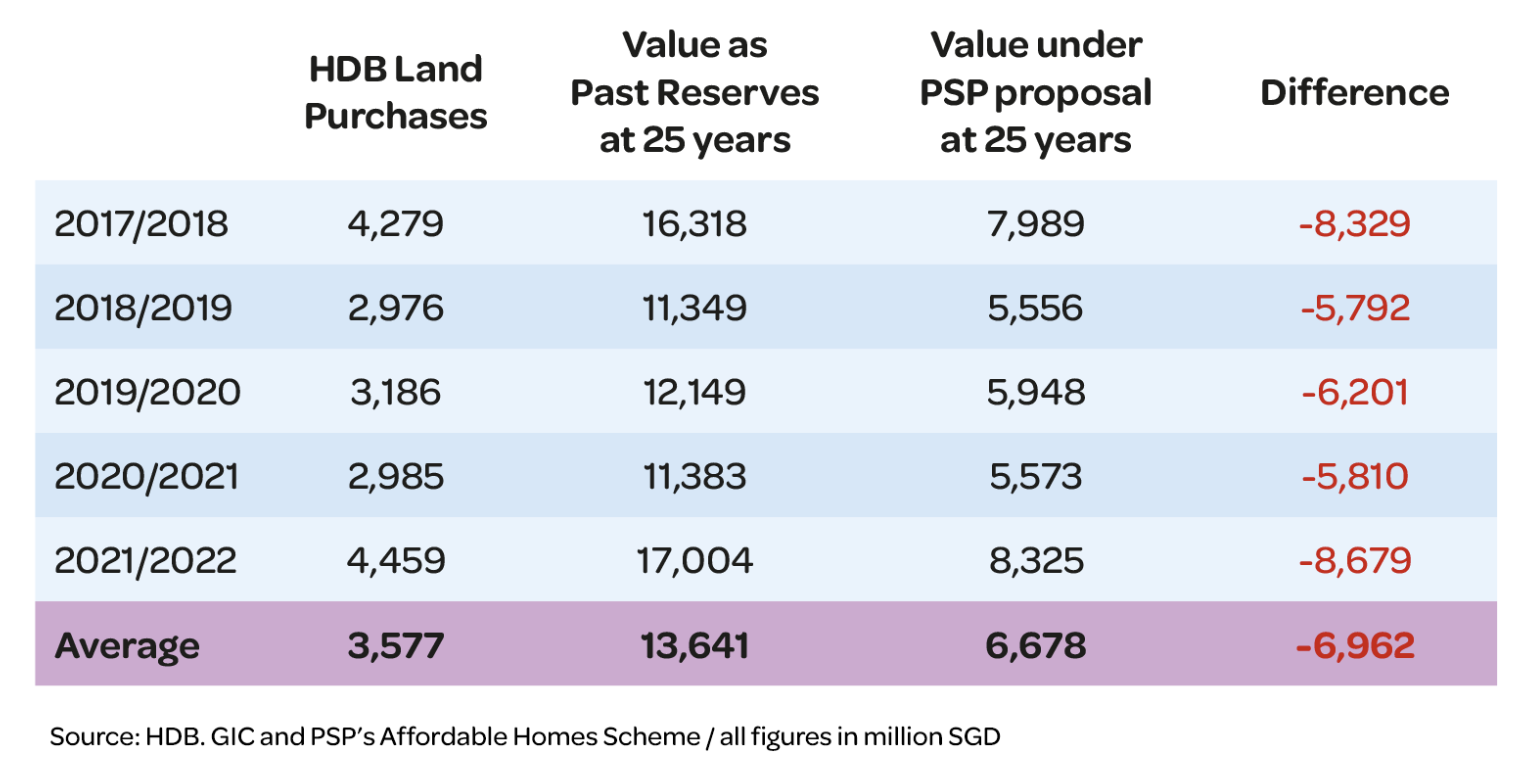

According to annual reports by the HDB, it spends approximately S$3 to S$4.5 billion on land each year (see table in the image).

The average for the past 5 years was around S$3.5 billion.

PSP proposes to charge people "land cost with accrued interest based on historical mortgage rates to the Past Reserves". By their own calculations it would be around 2.5% per annum over 25 years.

However, the money from land sales normally ends in reserves, ultimately managed by GIC for profit. GIC's annualised nominal return rate (before the huge stock rally during the pandemic, to make it fair) was 5.5% - more than twice PSP's proposal.

That's why, at the 25 year mark they presented, the difference in reserves accumulated from EACH YEAR OF LAND SALES would be, on average, around S$7 billion.

This is the long-term cost that future generations would have to bear, which would continue to snowball over time. As a result, we're talking about hundreds of billions of dollars across decades.

Let's not forget that the size of the reserves also impacts NIRC, which funds national budget every year. The smaller the reserves, the smaller the return on them and the smaller the influx of cash into the budget each year, meaning taxes would have to go up to make up for the difference.

And REMEMBER, you still have to pay for land if you want to move! There's no gain here, you only get the expense deferred not waived.

In other words, you end up paying about the same but at a much later date, while the entire country is bleeding money to fund this lunacy. NOBODY wins in this scenario, unless you're planning to live in one place for your entire life.

But that's not even the worst thing about this idea - yeah, it actually gets even worse the more you look at it :) - but more on this in the next post in a few hours... stay tuned!