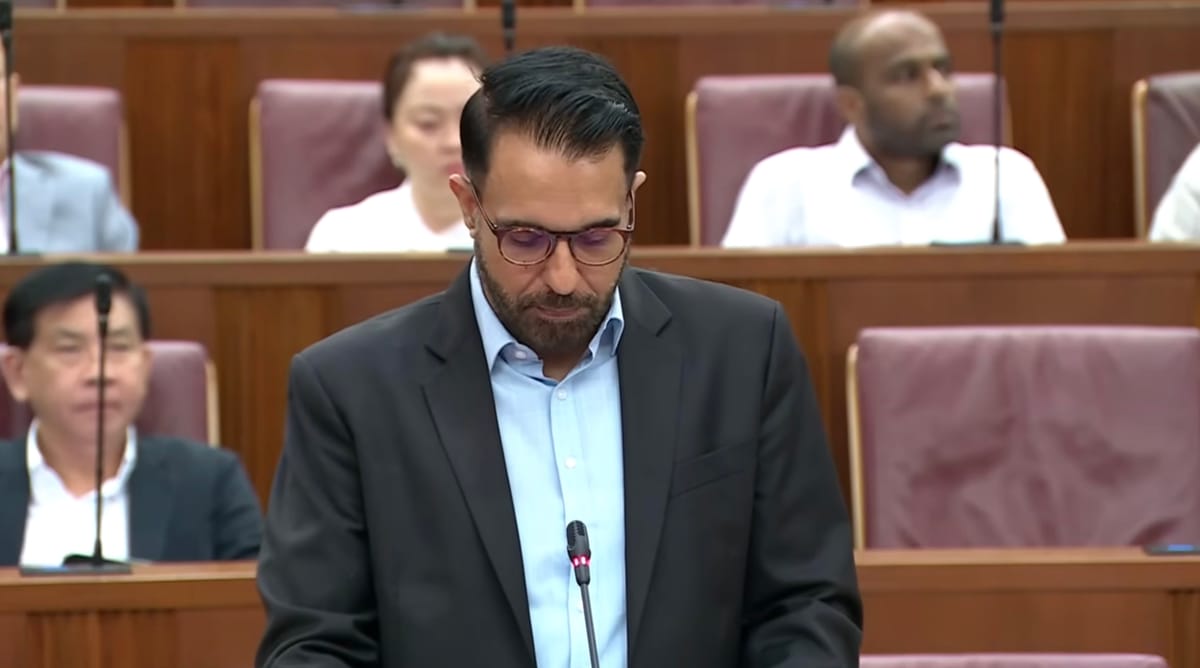

Singapore is well known around the world for its sound economic management and financial success, but the latest ideas presented by Jamus Lim are a new and rather unique kind of innovation.

In light of reports that GIC is about to receive an additional S$185 billion in excess foreign currency reserves from MAS for profitable management, the Workers' Party MP proposes that Singapore's central bank spends the money driving up the value of SGD, to cheapen goods imported to Singapore.

While it is true that a stronger domestic currency leads to higher purchasing power, allowing importers (and, thus, consumers) to buy more for the same amount of money, it would really be a first for any nation to intentionally seek to do it as an instrument of economic policy (outside of cases of deep trade imbalances) that would seek to lower consumer prices and, effectively, redistribute some wealth.

If history teaches us anything, it's the opposite that nations around the world have always attempted to do - and benefited from.

By driving the value of their currencies down, they supported domestic exports (since their goods were relatively cheaper to foreign buyers), which - in turn - guaranteed high levels of local employment, foreign investment, transfer of knowledge et al.

This is, among many others, the story of the rapid rise of China, which was, at various times, labelled a currency manipulator precisely due to keeping the value of the yuan artificially below what could have been a fair market price, keeping it more attractive to buy from.

But to INTENTIONALLY make your country LESS COMPETITIVE? That's a first, I think.

Jamus argues that Singapore's effective average exchange rate vs. major currencies is lower than it was, e.g. in 1970 - but this is a typically academic tool that is misused to arrive at an, ultimately, wrong conclusion because of completely different circumstances (a common sin in the academia, where few venture out their door).

Exchange rates are not the only measure of international competitiveness, after all, and there is far more to the cost/benefit analysis that businesses undertake before they decide to conduct business in or through a particular place.

As a highly developed country, Singapore is already feeling the pinch of competition from less developed neighbours, who might not be able to offer the same quality or stability but can promise much lower prices.

Strengthening the SGD would only worsen its position, as it would become even more expensive for foreign entities to conduct business through Singapore.

And while Jamus appears to be dangling the carrot of lower prices in supermarkets in front of ordinary Singaporeans, he conveniently fails to mention that the risk it brings is that jobs are going to become harder to come by or may begin moving elsewhere, to save investors some money.

Alternatively, local salaries might be kept at a lower level to compensate for currency rate differences. Fewer bonuses, fewer raises, longer expected working hours.

How good is your cheaper shopping if you're out of a job, got your bonus cut or have your salary frozen for months?

A free market will always find a balance - it's surprising that an economist would ignore the ways it can adapt.

He also appears to have forgotten that for a developed country, Singapore still boasts a highly robust manufacturing sector, whose competitive position is directly dependent on balanced currency exchange rates.

So, yes, on one hand, it may appear that keeping the SGD strong, given how dependent Singapore is on imports, would help the country get a bigger bang for its buck. But as a trade and business nexus, its relationship with the world extends both ways.

It still SELLS a lot to it and cannot risk cutting the branch it is sitting on for little else than expedient political populism, painting a mirage of cheaper shopping.

(Of course, the timing and the points made are not a surprise, given global inflation and the planned raise of GST by the government.)

But what the Workers' Party chief economist is suggesting is de facto squandering tens of billions of dollars in foreign reserves that can yield sizable returns by being invested by GIC on manipulating international currency exchange rates to lower consumer prices by a few per cent to win votes in support - even as it endangers Singapore's competitive position and local employment.

And he is doing so during the worst pandemic in a century, with a global economic crunch, a likely incoming collapse of the asset bubble in America and a global minimum tax rate kicking in this year, eroding some incentives that the largest companies in Singapore have been granted.

Now ain't that excellent timing for making Singapore even more expensive to do business in!?

We've already seen how WP is tempting voters by promising to spend more money by diverting funds from national reserves to the budget - and now it wants to use monetary policy for the same purpose as well.

What I have yet to see is any proposal on how to MAKE more money instead of spending what someone else has built up over the years...