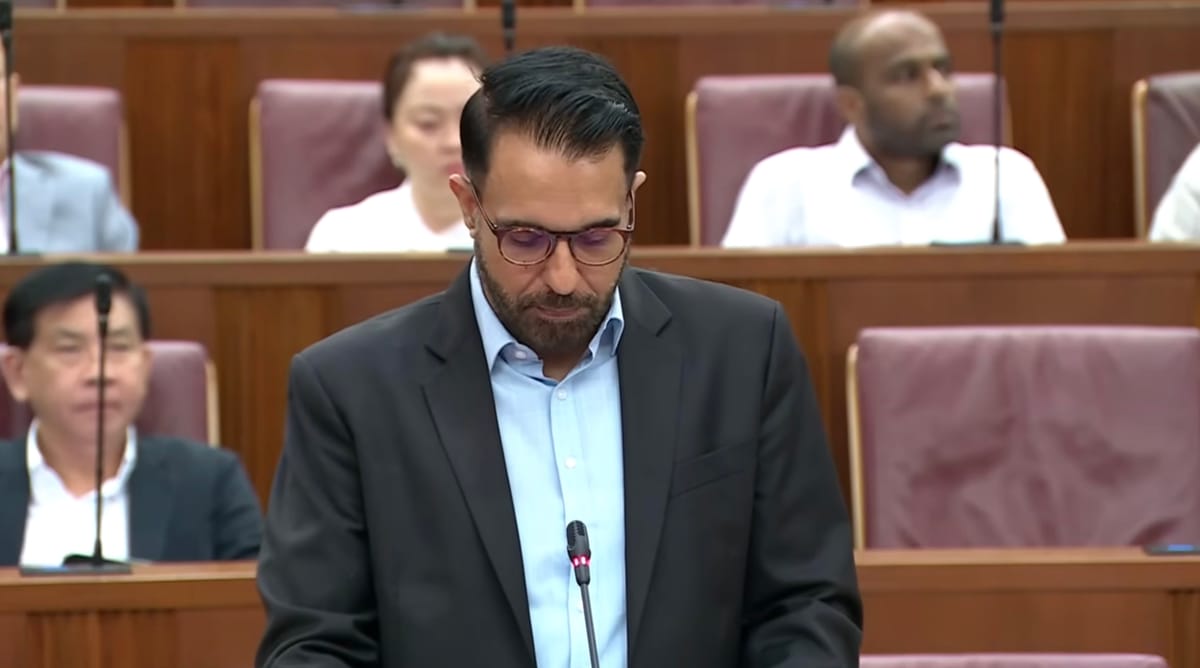

Ladies and gentlemen of Singapore, the country is ready for some serious cost cutting in the administration as it closes down its central bank, which is obviously no longer needed as its role can be now done by one man!Unsurprisingly, just moments after MAS announced adjustments to its policy, to apply some brakes on the SGD appreciation, our favorite Singaporean economist, Jamus Lim, was out on social media to claim at least partial credit for it (to the cheers of his fans who don't seem to know much about central bank's policy).It has about as much merit as Lim Tean taking credit for dropping egg prices (seriously, what's wrong with some people?).Jamus is clearly using the global inflation crisis to score points with domestic voters, without addressing the full picture.

And the full picture is that exchange rate is CENTRAL to MAS policy. In fact, it is a rarity among central banks, most of which use interest rates in their monetary decisions.MAS does not given Singapore's dependence on trade and its general lack of self-sufficiency given that it's just a small island that can't produce much on its own.That's why performance of Singapore dollar against other currencies is so important (and why Singapore's foreign reserves are so vast).In the past 12 months alone MAS has conducted 3 other tightening exercises already but inflation is only one of its concerns.Before it makes the next moves it has to evaluate the situation in the labour markets and the country's overall economic performance, to see if local competitiveness is not adversely affected and that people still have jobs - or plenty of them to choose from.

What good is lower inflation if you don't have a job or your job doesn't pay well? Or that you're not going to get that annual bonus after all?This is what Jamus is not telling anyone because he's not concerned with the impact of his proposals but rather in placing himself in a position to claim credit for policies that are not his making, creating a false impression he has some influence when he has none.(Again, like Lim Tean and eggs )

If economic policy-making was so easy we wouldn't need a couple of thousand people running various affairs of the central bank - just one bloke making dictatorial directives from his chair, thinking he can guide the entire country.

Let's not forget that for all the whining about inflation, Singapore is already managing it extremely well.Overall inflation hit 5.6% in May, compared to 7-8% in developed Europe and New Zealand or 9% in the US, with some less-developed countries hitting double digits.Now, mind you, this is 5.6% in a country which cannot rely on domestic production of food, fuels or other resources and has to import pretty much all of it from around the on vehicles powered by very expensive oil and gas.

Singapore is extremely exposed to imported inflation and yet its figures are better than the countries it imports from. Think about that.And here waltzes in an academic economist who has never held a position of even comparable responsibility, claiming - "we can do better, without any negative consequence to employment and economic performance!"Right.And then, by the way, he follows up with saying the government should spend more out of the budget on handouts after it expects a bounce-back in fiscal revenues - ignoring the fact that it was forced to lay out over S$50 billion on support schemes in the past 2 years and is now trying to balance its books to recoup at least some of the funds which helped the country coast through the pandemic.Are there any limits to this irresponsibility?