In the second chapter of my four part miniseries on SPH I’m taking a closer look at the figure of the company’s CEO and his performance. If you missed the first part, you can read it here.

Joe Kennedy - JFK’s father - observed that a great hint as to when to sell stocks before the market crashes was to listen to what regular people were talking about. When shoeshine boys, janitors, cooks start talking about the stock market - that’s when you sell.

This story springs to mind whenever I see people eagerly passing judgment on business executives or politicians - what the internet has made so easy today.

They have no idea what they are talking about, which means they are most likely wrong.

Just like for Joe Kennedy, it was a signal to sell stocks, for me it’s a signal to dig for information to see what the truth really is. Most people are wrong about most things, most of the time.

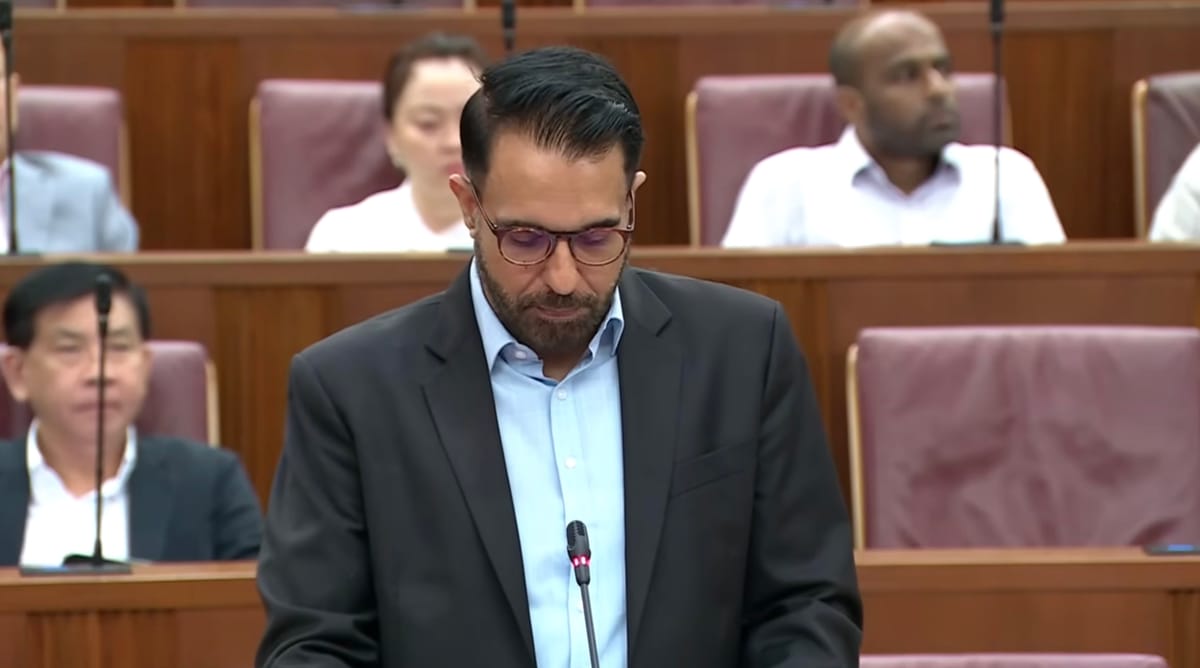

So, when SPH CEO Ng Yat Chung found himself chastised by the masses not only for his angry rebuke of an ignorant reporter but also for his track record as a business executive, I had to find out more about his performance and see if the public knows what it’s talking about.

Paper generals

There’s a prevailing belief in Singaporean society that PAP-friendly generals are parachuted into business or politics to continue easy, well-paid careers until retirement, protecting party interests while not doing much.

It doesn’t take long to realize that if that was the case, Singapore wouldn’t be able to achieve as much as it has.

A post shared by @sonny_liew

This habitual ignorance (which is a major problem in every society in the world) was nicely illustrated by Sonny Liew, who I’m sure thought he was making an edgy visual commentary on local political affairs when, in reality, he presented a self-portrait of himself, several other self-righteous pundits and large swathes of the public.

They tend to believe NYC et al are just a bunch of incompetent PAP apparatchiks enjoying party sinecures in corporations under governmental control. They are also firmly convinced that PAP-linked management is doing little (or doesn’t know what it’s doing) and that the problems companies like NOL or SPH were/are facing are a result of incompetence and mismanagement by these generals with, seemingly, no relevant experience.

(Ironically, their own, very real, lack of experience is not stopping them from making these judgments…)

So, I’ve decided to take a closer look, and it didn’t take long for me to discover that the truth is quite a lot different.

Not a gentleman

Anecdotal evidence and his own admission suggest that Ng is not necessarily a nice guy and must be a demanding person to work with (what can you expect from a 3-star general, though?). The know-it-all public widely scoffed at his angry response to the CNA journalist, but - as I explained in this Facebook post - I saw a guy proud of his efforts who took great offence at the suggestion that integrity was in any way sacrificed at SPH for money.

His reaction revealed a few things:

- He cares about the job and is viscerally and emotionally engaged in it.

- He may not be pleasant, but he’s ready to fiercely defend himself and his troops in the face of unfair accusations - even with cameras rolling.

- He’s probably quite disappointed that despite all the work put in, the company did not rebound to higher profitability.

Say what you will, but to me, that’s not how a parachuted figurehead behaves. If all he cared about was a cosy job and a fat paycheck, he’d have just glided through the press conference and disappeared behind his desk, making sure nobody paid attention to his salary.

He wants to succeed, and I don’t think you will find many professionals in the military - particularly those who have managed to climb the ranks - who like to lose (or don’t care about it).

The public may indulge fantasies about an incompetent paper general but when you look at the facts and figures, the reality is that he’s a fighter who took on a Herculean task of managing two already declining companies (NOL and SPH), in two sectors dealing with global problems and put in a lot of effort to salvage them.

That, in the end, a miracle didn’t happen and the businesses succumbed to overwhelming economic realities isn’t exactly his fault, is it?

Expectations were higher, of course, but sometimes the best way forward for a business is a merger with a bigger entity, to optimize operations and reap the rewards of economies of scale (like at NOL) or a spin-off in a new form, better suited for the circumstances (SPH Media).

Myths

Here’s how Mothership covered his appointment to SPH in 2017:

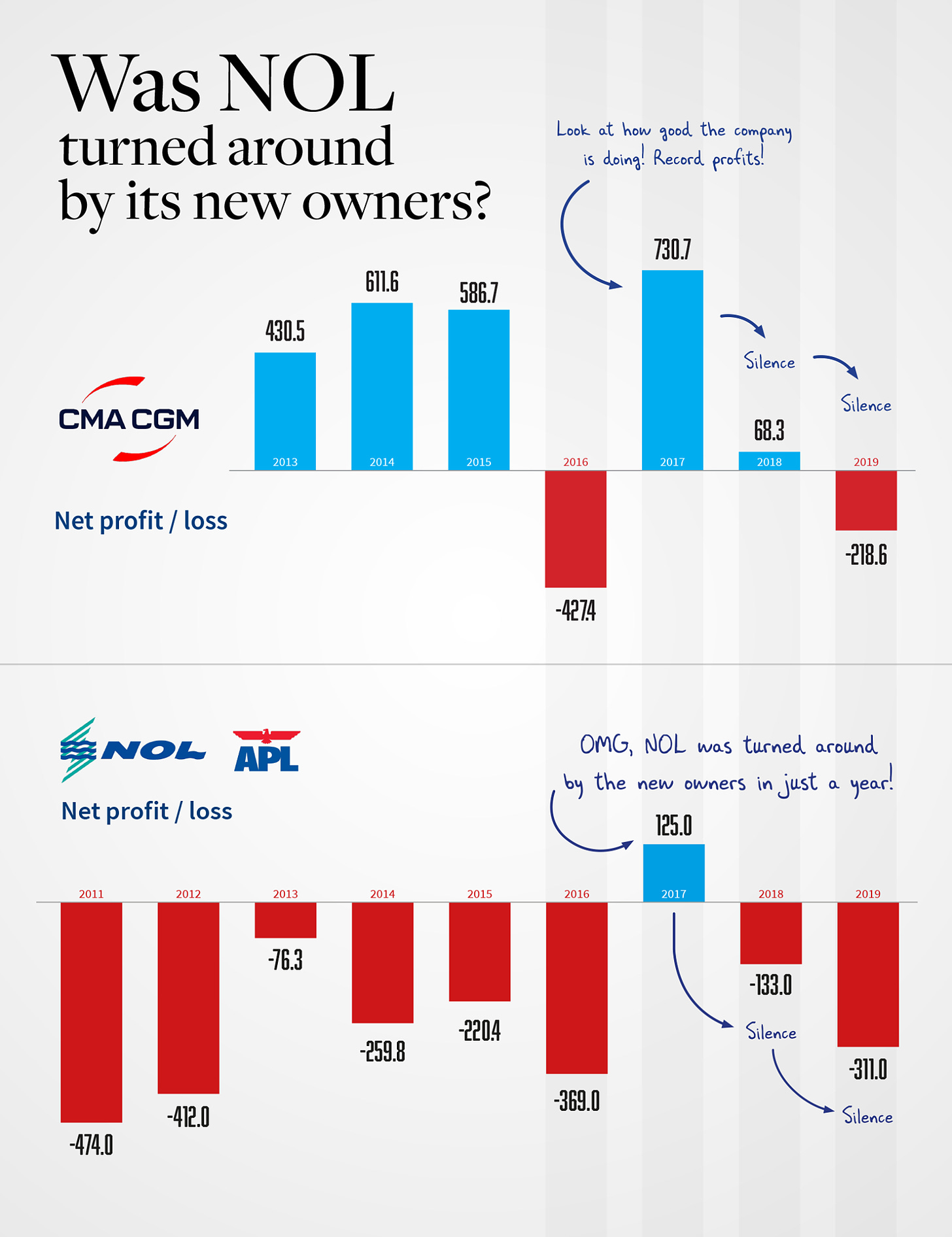

This is the moment when the myth of NOL’s turnaround was born, hurting NYC’s image badly. Even today, many people keep repeating the story of how he spent five years in the company, failing to produce a profit, and new owners quickly managed to get it back in the black.

The reality is, again, quite different.

The quick post-acquisition profit was a fluke in a year when NOL’s new parent company CMA CGM posted record results across the board. I’ve decided to go through all financial reports from that time, which have revealed that NOL returned to loss-making the following year. I posted my findings in a Facebook post published yesterday.

Unfortunately for SPH’s then-new CEO, the myth stuck and follows him until today as nobody bothered to check what happened to NOL in the following years. This keeps hurting him as people see his tenure at SPH as another failure, suggesting that he’s an incompetent executive.

Indeed, Singapore’s national publishing company was in a better financial situation than NOL - but it had already grappled with declining revenues and profits for several years due to the erosion of print advertising which used to be the main source of income that made it once a real cash cow.

Print ads are not coming back, and digital traffic is simply not nearly as profitable. As I explained in Part I, a decision had to be made whether the company is going to focus on profitability or serving the mission of reporting the news and providing it to as many people in Singapore as it can - because both of these simply cannot be married.

Metrics

Before you want to judge anybody, you must ask yourself what you’re judging them by. What is the real goal for SPH? Is it readership? Or is it profit?

If you judge Ng Yat Chung by financial results, then he has clearly failed to provide the desired results. After all, there are many media corporations around the world, and they have to be financially sustainable.

However, you have to bear in mind that he couldn’t use the same tools and methods as they did to increase profitability because the company also serves a public mission.

Sudhir Vadaketh used the opportunity to ridicule Singaporean “elites“, saying that “they have run the Straits Times into the ground”.

In reality, the Straits Times recorded the highest circulation in decades (or, perhaps, ever) last year - 458,200 copies daily (print + digital).

Overall digital readership for SPH titles has increased since 2017 by over 50% - from around 280,000 copies to over 450,000 daily in 2020 - growing every single year. (In fact, overall readership in print + digital for the main news titles has also kept growing every year.)

Is this what “running it into the ground” looks like? Is this how the company is supposedly lagging behind the times? By rapidly growing its digital subscriber base?

Contrary to what many people may believe, media titles published by SPH do not lack readers - they lack advertising revenue which has collapsed with the sunset of lucrative print advertising, while digital subscriptions can’t make up for these losses.

This is a problem ALL traditional media outlets are facing today globally.

So, if you want to criticize NYC for declining profits, you have to bear in mind that Rupert Murdoch had to write down billions of dollars in failed media investments in the past 5 years, that the Economist saw its profits de facto cut in half since 2017, despite raising prices and reducing circulation, or that the Guardian has forever depended on external funding to stay afloat (in a model that SPH Media may now adopt, not to be driven by financial goals anymore).

By financial metrics, SPH is doing disappointingly. But by readership metrics, it’s doing pretty well. So, what are you going to judge the CEO by? What is a greater priority for the national publisher?

Mission: Impossible

Taking over at SPH, Ng Yat Chung embarked on another impossible mission - salvage a media company against strong global headwinds.

Was he the best man for the job? Hard to say. Many think that someone younger or more experienced in the media would have been better. It’s not an unreasonable assumption - but in this day and age, even very experienced media moguls are suffering. And not only traditional but digital outlets are feeling the pinch as well (e.g. HuffPost had to lay off dozens of employees and close the office in Canada earlier this year).

Since he hasn’t accomplished all of the expectations, it’s understandable why there’s a sense of dissatisfaction. But there’s absolutely no guarantee that with anybody else in charge, the company could have achieved both high profitability and high readership. That it would make a lot of money and provide news to millions of Singaporeans at the same time.

His misfortune is that he was thrown into the deep end of the pool upon his transition to the corporate world. NOL was facing similar global shifts (in maritime shipping), due to which smaller companies had to either fold or merge with bigger ones. There was no reason to fight it in the end. In SPH he was up against it once more.

It seems to me that he was given these thankless tasks precisely because he is not the sort of a person anybody can say “no“ to (is anybody going to argue with a 3-star general and former Chief of Defence Force?).

Like a soldier, he was dropped into hostile territory, forced to fight tooth and nail to defend his position for as long as possible against mounting odds.

And, just like it often happens in war, a total victory might simply not have been possible.