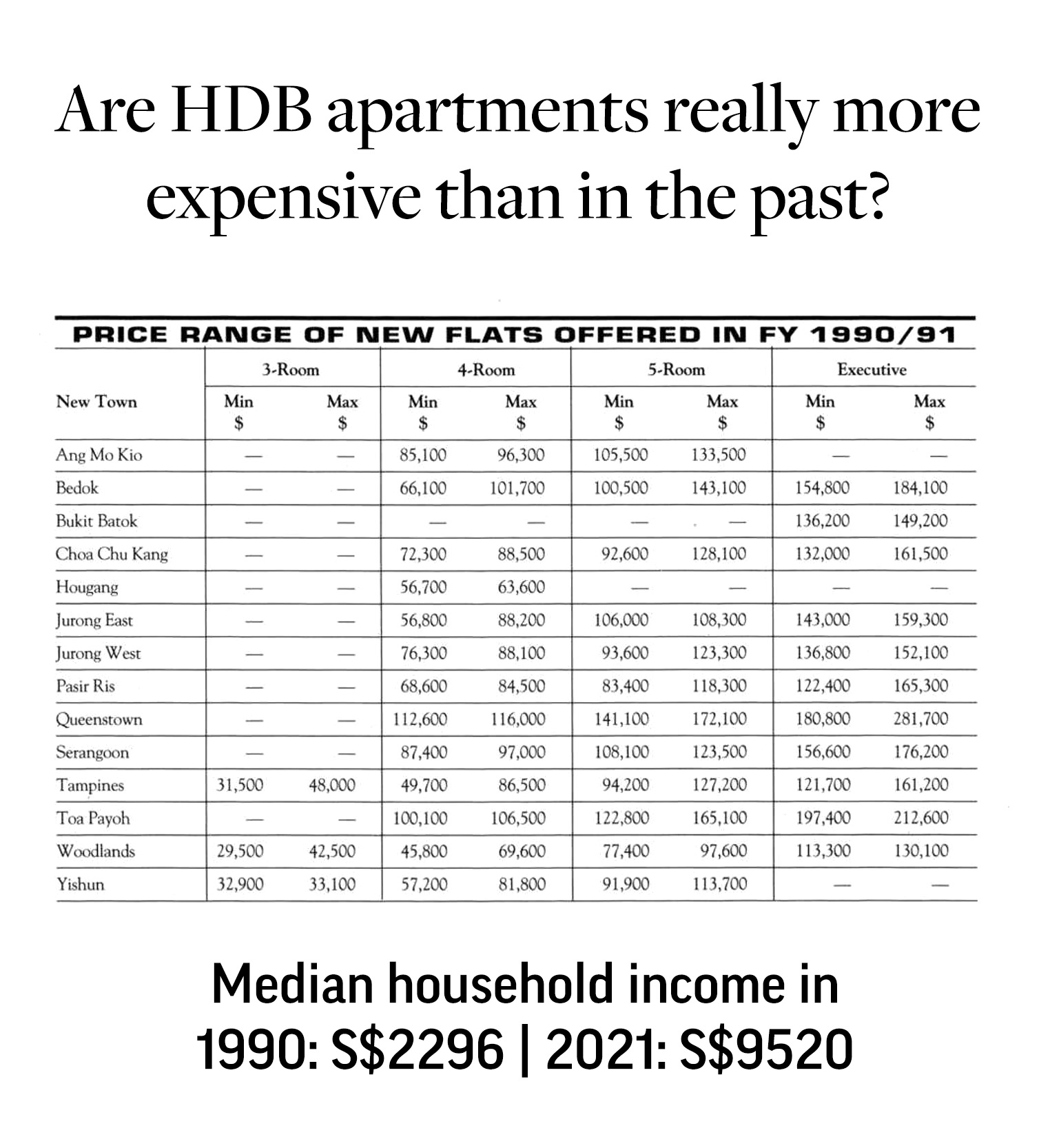

So many people have been lamenting just oh how much HDB apartments cost these days, and how their parents were able to pay theirs off in like 4 years but their children now take a mortgage for 25 years... and so on, that I've decided to do what any reasonable person should do: I looked at the numbers.

Of course, the behated PAP government is so opaque that.... it actually reveals exact sales figures in annual reports published by the HDB ;)

And since the earliest reliable median household income data I had access to was from 1990, I decided to compare it with the HDB report from just that year, three decades ago.

Very few 3R apartments were launched that year but fortunately we have plenty of data points for 4R and 5R options, up and down the country.

Let's start, however, with income.

Thanks to census from 2000, citing past figures, we know that the median household income in 1990 was $2296. We also know, since it's now regularly tracked and reported, that median household income in 2021 was $9520.

Why household income? Because HDBs are primarily bought by couples/families rather than singles, so it makes sense for the housing expense to be measured in relation to how much a family makes.

So, when we compare the figure from 1990 with 2021, the median household

income is 4.14x higher.

Now let's look at apartment prices.

The absolute cheapest new 4R was sold for just $45,800 in Woodlands that year. The absolute cheapest launched in 2021 was priced at $253,000 in Sembawang (you can check it in last year's report).

That is an increase by 5.52x - or about $63,000 more than if the lowest price increased by as much as salaries have.

But WAIT, don't jump to conclusions yet.

First of all, it proves that all those lamenting how someone was able to pay off their apartment in 5 years and now it takes 25, are rather exaggerating :)

Secondly, current prices do not reflect various housing grants that about half or more buyers of HDB apartments are eligible to receive. Enhanced CPF Housing Grant of up to $80,000, family grants, proximity housing grant etc.

So, yes, the BASE price of the cheapest 4R apartment in a new town has gone up by a modest amount over salaries but with various grants included the real purchase price of the apartment may be either close to or even below what they should cost relative to 1990 prices.

For better context let's also look at the other end. The highest minimum price for a 4R in a central, mature town, was $112,600 in Queenstown. The highest minimum price for a recently (Aug. 2022) launched BTO in Ang Mo Kio was $535,000 - a factor of 4.75x.

Remember all the whining about AMK being oh so terribly expensive?

This year's median household income figures aren't in yet but they are bound to be around $10,300, what would be around 4.5x of the 1990 median.

That's 4.5x for salaries vs. 4.75x for the upper tier 4R public housing (and, again, that's without the grants!).

Where is this dramatic gulf we keep hearing about?

In general, you will find that the base prices for apartments have gone up by around 4.5-5.5x, before housing grants. With grants it can be anywhere from a bit more expensive to a bit cheaper (relative to income), depending on what your situation is.

Need I mention the much higher standards, world-class infrastructure and MRT being able to get you pretty much anywhere in the city (as opposed to having to travel by bus if you lived anywhere away from the red and green lines back in the day)?

Roads, parks, shopping malls, restaurants etc. are all quite a lot more abundant these days and yet the relative cost of housing remains pretty stable.

But there's even a cherry on top - and that is that buying a new apartment comes with an instant premium of up to a few hundred thousand dollars that you save on a BTO vs. current resale offers.

So, not only are Singaporeans shielded from the open free market, where condos fetch a few million dollars, but new home buyers are additionally protected even from the domestic pond of the HDB resales, where prices of the largest apartments fetch over $1 million already, while the government is selling new ones at a discount of $200/300/400k in comparison. Yes, you need to wait a bit but it seems worth it, no?

Sadly, it seems even that is not enough for some... 🙄